cryptocurrency tax calculator uk

When you spend sell or trade a cryptocurrency you need to calculate the capital gains by disposing the coins in the following order. Your first 12570 of income in the UK is tax free for the 20212022 tax year.

Uk Tax Calc Online 58 Off Www Alucansa Com

To calculate your capital gains as an individual the HMRC requires you.

. You pay no CGT on the first 12300 that you make. Keep reading to learn more about how to use the cryptocurrency tax calculator. For 202122 the annual exempt amount is 12300.

UK crypto tax basics. Coins acquired within 30 days of the sale disposal 3 Total pool. Crypto-currency tax calculator for UK tax rules.

Latest news and advice on cryptocurrency taxes. How to calculate your UK crypto tax. The Result is.

Then youll need to specify the buy and sell date of your assets. How to calculate your uk crypto tax calculating cryptocurrency in the uk is fairly difficult due to the unique rules around accounting for capital gains set out by the hmrc. You only have to pay capital gains tax on overall gains above the annual exempt amount.

How to calculate crypto taxes in the UK. Under UK crypto tax rules profits on cryptocurrency disposals are considered capital gains and are accordingly subject to capital gains taxes. It helps you calculate your capital gains using Share Pooling in accordance with HMRCs guidelines.

CryptoTaxCalculator is designed to support the unique HMRC reporting requirements including UK-specific Same Day and Bed Breakfast. Choose how long you have owned this crypto. See the full HMRC guidance here.

If this is in the higher rate or additional rate tax band youll pay 20 on your capital gains from crypto. 10 to 37 in 2022 depending on your federal income tax bracket. Since then its developers have been creating native apps for mobile devices and other upgrades.

Short-term crypto gains on purchases held for less than a year are subject to the same tax rates you pay on all other income. At different points in the ten year history of cryptocurrency Bitcoin has fluctuated significantly in value. UK residents are subject to Capital Gains Tax at a rate of up to 20 on disposal of cryptocurrency.

The resulting number is your cost basis 10000 1000 10. If this is within the basic income tax band youll pay 10 on your capital gains from crypto. Koinly is a popular platform with a crypto tax calculator available in over 20 countries including the UK.

Enter your income for the year. Finally youll need to calculate the amount youll need to pay on Capital Gains Taxes and income tax based on your tax bracket. HMRC has published guidance for people who hold cryptoassets or cryptocurrency as they are also known explaining what taxes they may need to pay and what records they need to keep.

UK crypto investors can pay less tax on crypto by making the most of tax breaks. Choose your tax status. HMRC also suggests what cost you can deduct from disposal proceeds to calculate capital gain.

2021-2022 Tax Brackets Tax Calculator Cryptocurrency Tax Calculator Capital Gains. For companies profits or losses from cryptocurrency trading are part of the trading profit rather than a chargeable gain. Crypto received as salary.

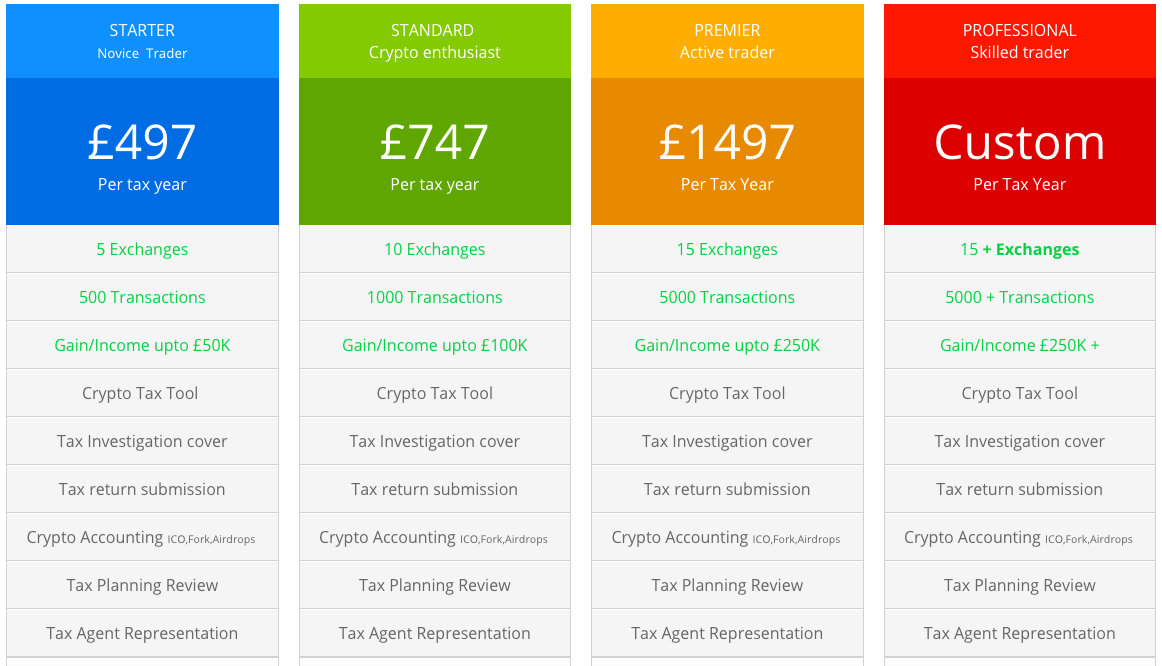

CryptoTaxCalculator performs tax calculations with a high degree of accuracy carefully considering complex tax scenarios such as DeFi loans DEX transactions gas fees leveraged trading and staking rewards. Best Crypto Tax calculator in the UK. With over 300000 users CoinTrackinginfo is one of the oldest and most trusted cryptocurrency tax calculators on the market today.

The original software debuted in 2014. Add the remaining amount to your taxable income. Coins bought on the same day as the sale disposal 2 30-day rule.

Learn how cryptocurrencies are taxed in your country. Crypto bitcoin united-kingdom tax cryptocurrency tax-calculator hmrc cryptoasset capital-gains tax-calculations cryptotax tax-reports Resources. Crypto tax breaks.

On December 10th 2021 you sold. For individuals income tax supersedes capital gains tax and applies to profits. You pay 127 at 10 tax rate for the next 1270 of your capital gains.

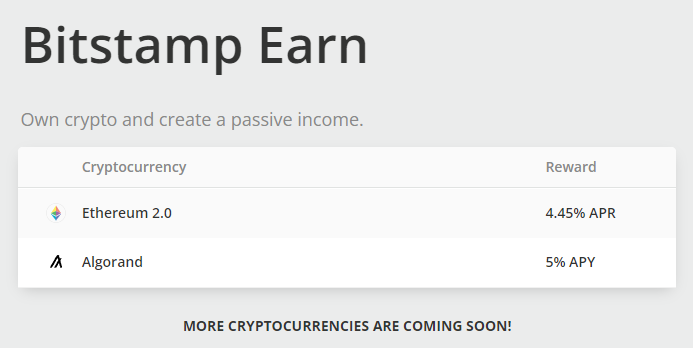

Income received from bitcoin mining airdrops or DeFi rewards. From a tax perspective investing in cryptocurrency is very similar to investing. You can also generate an Income report that shows your income from Mining Staking Airdrops Forks etc.

Also employees must pay Income Tax if they are paid in exchange tokens. The platform is also to start using Koinlys crypto tax calculator. Detailed case studies tutorials.

That means you calculate your capital gains and if the result is below the limit you dont need to. Those who bought Bitcoin back in 2008 when it was worth fractions of a dollar could potentially have made hundreds of millions of dollars in profit in 2017 when its value peaked at almost 20000 or in 2021 when it peaked at. You pay 1286 at 20 tax rate on the remaining 6430 of your capital.

Start for free pay only when you are ready to generate your. The Taxes Owed are. Uk crypto tax calculator with support for over 100 exchanges.

The use of this website is not to be constitute intend or to be considered tax advice financial advice legal advice or tax. Calculating cryptocurrency in the UK is fairly difficult due to the unique rules around accounting for capital gains set out by the HMRC. Using our cryptocurrency tax calculator you can determine your estimated capital gains tax liability by entering a few pieces of information.

Koinly helps UK citizens calculate their crypto capital gains. We have listed down 4 of the. 12570 Personal Income Tax Allowance.

All coins previously acquired. HMRC cryptocurrency tax gains can be reported in a Self Assessment tax return. Why is there a crypto tax UK.

Youll need to separate all your transactions into capital gains transactions and income transactions. Up to 500 USDT in bonuses for new users Trade Anytime Anywhere. To calculate your capital gains as an individual the HMRC requires you to keep track of your average cost basis for the token on hand aggregate your same-day transactions and ignore any wash sales.

Income tax may apply at a rate of up to 45. Heres an example of how to calculate the cost basis of your cryptocurrency. Take the initial investment amount lets assume it is 1000.

Ad Find the Next Crypto Gem on KuCoin1 Out of 4 Crypto Holders Worldwide Is with KuCoin. Calculating cryptocurrency in the UK is fairly difficult due to the unique rules around accounting for capital gains set out by the HMRC. Lets say you bought 500 worth of Bitcoin on December 1st 2020.

CoinTrackinginfo - the most popular crypto tax calculator. Crypto tax calculator software lets the users connect or import their cryptocurrency transaction data mainly the purchase price sale price and the crypto tax calculator tool automatically provides the gains or loss and other relevant information to populate your tax reports. Individual crypto activities that are taxable include.

In your case where your capital gains from shares were 20000 and your total annual earnings were 69000. Subtract your Capital Gains Tax Allowance 12300 from your total taxable gains. Capital gains tax CGT breakdown.

Divide the initial investment amount with the amount of crypto purchased lets assume 1000 coins.

Koinly Blog Cryptocurrency Tax News Strategies Tips

Koinly Blog Cryptocurrency Tax News Strategies Tips

Koinly Blog Cryptocurrency Tax News Strategies Tips

Koinly Blog Cryptocurrency Tax News Strategies Tips

Koinly Blog Cryptocurrency Tax News Strategies Tips

Track Your Cryptocurrency Portfolio Taxes Cointracker Is The Most Trusted And Secure Cryptocurrency Portfolio Tr Tax Guide Cryptocurrency Buy Cryptocurrency

What Is Apy In Crypto Best Apy Crypto Rates In May 2022

Koinly Blog Cryptocurrency Tax News Strategies Tips

Made A Killing With Crypto In 2021 How To Calculate Your Tax Bill

Calculate Your Net Income Manitoba Give Tax Rates Pensions Contributions And More Income Tax Net Income Income

Bitmarket Is Clean And Modern Design Responsive Html Template For Bitcoin Crypto Currency Exchange And Trading Company W Templates Cryptocurrency Bitcoin

Bitcoin Tax Calculator India Bitcoin Transaction Bitcoin Startup Company

Beartax Cryptocurrency Tax Software Bear Tax Twitter

Koinly Blog Cryptocurrency Tax News Strategies Tips

Adaugă Pin Pe Idea Inspiration

Singapore Corporate Tax How To Pay Tax Rate Exemptions Singaporelegaladvice Com

Credit Karma To Offer Tax Filing Through Turbotax Forbes Advisor